BUSINESS

The Ultimate Guide to Choosing the Perfect Business Suit for Men

A well-fitted business suit is more than just clothing; it’s a statement of professionalism, confidence, and taste. Whether you’re heading to an important meeting, attending a corporate event, or just want to up your style game, the right suit can make all the difference. With so many options available, choosing the perfect suit might feel overwhelming, but don’t worry—we’re here to help you master the art of picking the perfect business suit.

This guide will walk you through everything you need to know about business suits for men, from understanding different styles to selecting the right fit, color, and fabric. By the end, you’ll be equipped to elevate your professional wardrobe with confidence and ease.

Why Every Businessman Needs a Good Suit

When it comes to business attire, nothing commands respect and attention like a sharp suit. Here’s why every professional should invest in at least one:

- First Impressions Matter: Whether you’re meeting clients, pitching investors, or simply networking, a well-tailored suit sends a message of competence and credibility.

- Versatility: A good suit is incredibly versatile. Swap out the tie for a more casual look or pair it with different shirts to create multiple outfits.

- Boosts Confidence: Looking good often equates to feeling good. A great suit can be a powerful confidence booster in high-stakes situations.

With these benefits in mind, it’s clear why a suit is a must-have in every businessman’s wardrobe. Now, let’s break down how to choose the right one.

How to Choose the Perfect Business Suit

1. Understand Different Suit Styles

Before you start shopping, familiarize yourself with the common suit styles and what they signify:

Single-Breasted vs. Double-Breasted

- Single-Breasted: The classic and most versatile style, featuring one column of buttons. Ideal for most business settings.

- Double-Breasted: Features two parallel columns of buttons. This style has a more formal and traditional feel, often worn in high-powered or prestigious roles.

American, British, and Italian Cuts

- American Cut: Known for its relaxed fit and natural shoulders, this style is great for comfort and practicality.

- British Cut: Features structured shoulders, a slim waist, and a fitted chest. Perfect for men who prefer a more formal, traditional look.

- Italian Cut: Slim and sleek with soft shoulders and tapered legs. Ideal for those who want a modern, European-inspired aesthetic.

2. Choose the Right Fit

The fit of a suit can make or break your look. Here are the three main fits to consider:

Slim Fit

A modern, tailored look that hugs the body without being too tight. Best suited for lean or athletic body types.

Classic Fit

More relaxed with room to move, offering comfort without sacrificing style. Great for traditionalists or those with broader builds.

Modern Fit

A middle ground between slim and classic, offering a flattering yet comfortable silhouette. Versatile for most body types.

When trying on suits, pay attention to key areas like the shoulders, chest, and pant length. The shoulders should sit naturally without excess fabric, and pants should break slightly above the shoe.

3. Select the Best Fabric

The fabric of your suit determines its comfort, durability, and appropriateness for different occasions:

- Wool: The most popular material for business suits, thanks to its versatility and durability. Wool suits work well year-round.

- Cotton: Lightweight and breathable, making it ideal for warmer climates or less formal environments.

- Linen: A great summer option, though it wrinkles easily, giving it a more casual vibe.

- Polyester Blends: Budget-friendly and wrinkle-resistant but less breathable than natural fabrics.

For a professional setting, wool is typically your best bet.

4. Pick the Right Color

Color choice is critical, as it affects the suit’s versatility and formality. Here are the top business-friendly colors:

- Navy: Timeless and versatile, navy suits are perfect for nearly every business event.

- Charcoal Gray: Another classic, gray exudes professionalism and elegance.

- Black: Ideal for formal events but may be too somber for everyday office wear.

- Earth Tones (e.g., brown, tan): Great for creative industries or semi-formal settings but less common in traditional business offices.

If you’re building your first suit wardrobe, start with navy or charcoal gray for maximum versatility.

5. Invest in Tailoring

Even the most expensive suit won’t look good if it doesn’t fit properly. Minor adjustments by a skilled tailor can make a world of difference. Focus on these areas:

- Shortening or lengthening sleeves

- Tapering pant legs for a sleeker silhouette

- Adjusting the jacket to hug your body without pulling

6. Don’t Forget Accessories

Complete your look with the right accessories:

- Shirts: Opt for classic white or light blue for a traditional business look.

- Ties: Keep it simple with solid colors or subtle patterns.

- Shoes: Black or brown leather Oxfords or brogues work best for business attire.

- Belts: Match your belt to your shoe color for a polished look.

Attention to detail can elevate your style from good to great.

Caring for Your Suit

To ensure your suit lasts for years, follow these care tips:

- Avoid Over-Washing: Dry clean only when necessary to maintain the fabric’s integrity.

- Use a Garment Bag: Protect your suit from dust and damage during storage.

- Steam, Don’t Iron: Steaming removes wrinkles without flattening the fabric texture.

Proper care will keep your suit looking sharp through countless professional events.

Upgrade Your Style Game Today

The perfect business suit is an investment in your professional image, confidence, and success. Whether you’re a seasoned executive or just starting in the corporate world, following these tips will help you choose a suit that fits your style and needs.

If you’re ready to transform your wardrobe, start with the basics we’ve outlined above. And remember, a great suit is only part of the equation; how you wear it—from confidence to accessories—is what truly sets you apart.

FAQs

Q: How often should I dry clean my suit?

A: It’s best to dry clean your suit only when necessary, such as every few months or after noticeable stains. Over-cleaning can weaken the fabric and reduce its lifespan.

Q: Can I wear my business suit in all seasons?

A: Yes but consider the fabric. Wool is versatile year-round, while linen suits are ideal for summer, and heavier fabrics like tweed are perfect for colder months.

Q: What’s the best way to store my suit?

A: Always use a high-quality hanger to maintain the suit’s shape and keep it in a garment bag to protect it from dust and moisture.

Q: Are there any accessories that pair best with a suit?

A: Accessories like a polished watch, a pocket square, and a well-chosen tie can enhance your suit’s appearance and complete your professional look.

Q: How can I make my suit last longer?

A: Rotate your suits regularly, store them properly, and follow care tips like steaming instead of ironing to extend their durability.

BUSINESS

.Ydesi: Exploring Its Significance and Applications

The term .Ydesi is steadily gaining attention across industries, yet many remain unclear about its full significance and real-world applications. Whether you’re new to .Ydesi or looking for deeper insights, this blog aims to unravel its importance and showcase its versatility across diverse sectors.

You’ll learn about the origins of .Ydesi, why it matters, and how it’s being applied in practical scenarios. By the end of this article, you’ll have a better understanding of how .Ydesi could revolutionize various workflows.

What is .Ydesi?

.Ydesi isn’t just a buzzword—it’s a cutting-edge system/tool (define .Ydesi more explicitly depending on what it refers to, such as software, a framework, methodology, etc.).

Officially introduced in [relevant year], .Ydesi was designed with the goal of amplifying [specific purpose]. Its adaptable nature allows it to integrate seamlessly into various business, creative, or technological landscapes.

Core Features of .Ydesi:

- Scalability: [Example feature description]

- User-Friendly Design: [Feature description]

- Flexibility Across Platforms: [Feature description]

With these features, .Ydesi is becoming indispensable for those aiming to stay competitive and efficient in their respective industries.

Why .Ydesi Matters

To fully grasp the importance of .Ydesi, you need to understand the issues it addresses. Today’s digital and organizational landscapes are swamped with [describe challenges]. .Ydesi tackles these obstacles with its innovative features that streamline processes and yield tangible results.

Key Benefits of Adopting .Ydesi

- Improved Efficiency: Businesses report up to a [specific percentage] increase in workflow efficiency after implementing .Ydesi.

- Seamless Collaboration: Features [describe like team management tools, shared resource hubs, etc.] facilitate smarter teamwork.

- Cost Savings: By reducing redundancies in [specific processes], .Ydesi helps teams cut operational costs.

- Customizability: Whether you’re an enterprise or an individual, you can tailor .Ydesi to suit your exact needs.

These advantages illustrate how .Ydesi goes beyond being a standard tool—it becomes a central asset in achieving organizational goals.

Practical Applications of .Ydesi

1. Business Operations

Streamlining processes is where .Ydesi shines the most. Companies leverage it to optimize supply chain logistics, reduce administrative bottlenecks, or even bolster decision-making through AI-backed solutions.

Example Use Case

A mid-sized firm using .Ydesi reported cutting approval times for internal processes by 35% within the first quarter of adoption.

2. Creative Industries

.Ydesi supports creative teams by centralizing resources like brand guidelines, design templates, and project timelines.

Example Use Case

Creative agencies cited reduced delivery times for client projects when incorporating .Ydesi-powered frameworks.

3. Education

Whether managing curricula or conducting research, .Ydesi plays a critical role in modern educational institutions by facilitating centralized learning environments.

Example Use Case

[Insert a reference to how a specific university improved scheduling or engagement tracking using .Ydesi].

4. Healthcare

The complexity of managing healthcare operations is often overwhelming, but .Ydesi simplifies patient management systems, billing workflows, and even telemedicine platforms.

Example Use Case

Hospitals leveraging .Ydesi’s customizable tools experienced an 18% increase in operational satisfaction among staff.

5. Freelance Work

Freelancers often manage multiple clients and tasks simultaneously. The organizational tools .Ydesi offers help independent contractors stay on top of deadlines and communications.

Example Use Case

Freelancers using .Ydesi noted improved time management and client satisfaction scores.

Tips for Implementing .Ydesi Effectively

To enjoy the full benefits of .Ydesi, thoughtful implementation is essential. Here’s how you can ensure seamless integration into your workflow.

- Understand Your Needs: Identify why your team or organization needs .Ydesi. From productivity tools to workflow automation, aligning features with your goals ensures success.

- Train Your Team: Conduct training sessions to familiarize your team members with .Ydesi. The more confident they feel using it, the quicker you’ll see results.

- Start Small: Begin with one department or project before scaling up. This allows for troubleshooting and feedback to fine-tune usage patterns.

- Regularly Review Performance: Periodically evaluate how well .Ydesi is meeting your objectives and adjust settings or workflows accordingly.

How to Get Started with .Ydesi

If you’re intrigued by what .Ydesi has to offer, you’re not alone. Many individuals and organizations are already seeing its capabilities take their efforts to the next level.

To begin, visit [insert URL or platform details]. Depending on your needs, you can sign up for a trial or reach out for a consultation that aligns .Ydesi’s potential with your unique requirements.

Bringing It All Together

The significance of .Ydesi extends far beyond its basic functionalities. From empowering businesses to fostering creativity and collaboration, its applications are as diverse as its users. By integrating .Ydesi into your processes, you’re investing in efficiency, innovation, and growth.

Now the only question is—are you ready to explore what .Ydesi can do for you?

BUSINESS

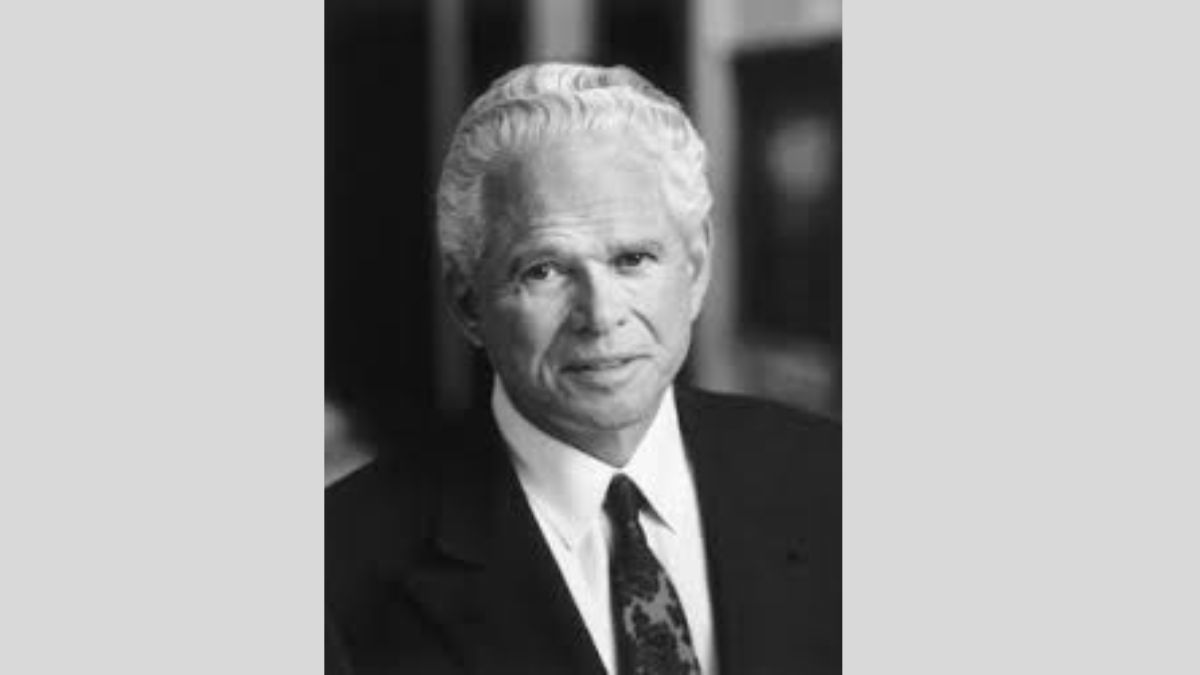

John Teets, Dial and Greyhound Chief, Dies at 77

The business world has lost one of its most trailblazing minds. John Teets, the former CEO of Dial Corp and Greyhound, passed away at the age of 77. A visionary leader with an incredible knack for revitalizing businesses, Teets left a lasting legacy that continues to shape the industries he touched.

This article pays tribute to his extraordinary life, detailing his career highlights, leadership philosophies, and the profound impact he made on American businesses.

Early Life and Career Beginnings

John Teets was born in 1945 in South Dakota and grew up in a working-class household. His early experiences instilled in him a tireless work ethic and determination—qualities that would later define his career. Teets began his professional career in journalism, earning a degree from the University of Denver and working for the Associated Press. But he soon transitioned into the corporate world, where his talents for leadership and strategic thinking became abundantly clear.

Revolutionizing Dial Corp

Teets joined Dial Corp in the 1970s and quickly rose through the ranks. By 1981, he had been appointed CEO. At the time, Dial Corp was a struggling conglomerate juggling operations in various sectors, including soap, food products, and services.

Under Teets’ leadership, Dial underwent a systematic transformation. Teets refocused the company’s portfolio, choosing to divest non-core businesses and streamline operations. His sharp business acumen allowed Dial to hone its existing strengths, particularly in consumer goods such as soap and personal care products.

Teets’ efforts propelled Dial Corp into profitability and set it on a course for long-term success. His tenure remains a textbook example of how targeted strategic decisions can rescue a struggling company.

Reinventing Greyhound

One of John Teets’ most notable achievements came when Dial acquired Greyhound in the early 1980s. Greyhound, the iconic bus company, was facing declining ridership and financial struggles. Many believed the company was beyond saving, but Teets saw opportunity where others did not.

Teets implemented sweeping changes aimed at modernizing Greyhound’s operations. He overhauled the fleet, introduced better service models, and executed effective marketing campaigns to reinvent the brand. Most importantly, Teets identified the need for customer-centric innovation—something that set Greyhound apart in the competitive transportation industry.

Remarkably, under Teets’ leadership, Greyhound was able to regain public trust and rebuild its reputation as an affordable, reliable means of long-distance transportation.

Strategic Leadership and Legacy

John Teets was renowned for his sharp eye for strategy and his ability to execute decisive action at the right time. His leadership philosophy combined pragmatism with innovation, and he was not afraid to make bold moves—even when the odds seemed stacked against him.

Above all, Teets placed immense value on teamwork. He believed that the best organizational changes came from collaboration, enabling employees at all levels to feel a sense of ownership in the company’s success.

Many who worked alongside Teets praised his charismatic personality, deep strategic understanding, and unrelenting ambition. Beyond just being a corporate leader, Teets inspired individuals to aim higher and do better.

His Impact and Future Lessons

Though John Teets achieved great success during his lifetime, his influence extends far beyond the accomplishments listed under his name. His work revitalized entire industries and demonstrated how businesses could thrive even amidst economic turbulence.

For leaders and entrepreneurs, Teets’ career serves as a masterclass in adaptability and vision. His ability to view challenges as opportunities, coupled with his relentless focus on customer satisfaction, stands as a guiding light for future generations.

Honoring a Life Well-Lived

John Teets’ passing marks the end of an incredible chapter in American business history, but his contributions are far from forgotten. Whether it was saving Greyhound from irrelevance or ensuring Dial Corp’s survival, Teets proved time and again that a visionary leader can achieve the impossible.

He is remembered not only as a business luminary but also as a mentor, friend, and inspiration to those who had the privilege of knowing him.

John Teets’ remarkable journey in the world of business leaves an indelible mark on history. His visionary leadership, unwavering commitment to customer satisfaction, and ability to transform industries serve as a timeless source of inspiration for future generations. As we honor his legacy, we celebrate not only his business accomplishments but also the profound impact he had on the lives of those fortunate enough to know him. May his legacy continue to inspire bold ideas and innovative leadership, guiding us toward a brighter future.

May his legacy continue to foster bold ideas and innovative leadership for years to come.

BUSINESS

Importance of Customization: The Value of Investing in Trade Show Exhibits in Chicago

Chicago trade shows continue to be a critical part of the marketing strategy for B2B businesses as they offer unique benefits for product showcases, brand recognition, and networking opportunities with potential clients and business associates. Nonetheless, with numerous businesses vying for the same attention, standing out is often easier said than done. One of the easiest ways to ensure that your company is remembered is by utilising trade show exhibits in Chicago tailored specifically to your business.

This article will discuss the customisation advantages and how putting in the effort to build a booth particular to your brand will pay off. From enhanced visitor engagement to effective brand representation, many custom-built booth builders can help transform your branding identity, significantly impacting your trade show results.

Why You Should Use Custom Booths For Trade Show Success

When participating in a trade show exhibition in Chicago, your company competes for attention with self-representing booths from other companies for a specific audience. Using a generic trade show booth will not capture the brand identity of your business due to the over development in the market. Custom booths, however, are built to suit your show’s specification and bespoke brand identity, helping create an identity that is hard to ignore.

- Tailored Brand Messaging: A booth that is custom designed will cater to the needs of every business by incorporating the brand messaging into the design through logos, colours, signage, and even displays of the merchandise.

- Optimized Visitor Flow: Custom booth builders design and tailor custom booths that fully optimize the easiness of the guide provided by sales personnel so that the attendees can flow freely without feeling obstructed while having a look at the numerous offerings provided at the booth.

- Elevated Attention: A custom trade show booth that is not only attractive but also distinct can appeal to a greater number of people. This is beneficial for gaining competition and foot traffic for the business. Using custom trade show exhibits in Chicago enables companies to make the branding experience impressive and unforgettable.

Custom trade show booths in Chicago are crucial for brand positioning. Compacting a lot of information into a small space is easy; however, making it interesting is the real challenge.

Benefits of Using Custom Trade Show Booth designers

Companies could work with professionals for custom booth design to benefit from their knowledge and ensure the design they use maximizes their trade show opportunities.

- Tailor Made Designs and Data: The custom trade show carpet displays work elegantly through the designs provided by the builders. After understanding the client’s objectives, these builders work harder in detail where the design exceeds the vibe of their brand. Implementing strategies could foster launch increases, new products et cetera, and be marketed through trade shows or other public events.

- Premium Materials Utilization: With skilled booth builders, you get access to premium materials and advanced technologies, guaranteeing that your booth is visually appealing and durable. Custom made booths are constructed with longevity in mind which requires you to only pay once for vital components that can be used in subsequent trade shows, increasing your ROI in the long run.

- Managing a Trade Show Project: Custom booth builders take care of everything from the first design to the installation of the booth. Your team is not burdened with logistics and scheduling. Custom builders handle everything, allowing the client’s staff to easily interact with clients and focus on marketing the brand. This granularity ensures there is no stress faced when attending a trade show.

When collaborating with professional custom booth builders, they ensure the booth will not only be useful but also the centerpiece of the trade show floor which adds unexpected expertise in the intersection of functionality and creativity.

Customization Provides Flexibility and Scalability Options

Like we mentioned before, one of the greatest advantages of custom booth rentals is their flexibility and scalability. Custom booths are suited for different sizes of trade shows and can be used at both large——scale conventions as well as smaller niche events.

- Adaptable Design: Custom booths are suited for both smaller industry events as well as larger multi-day trade shows. Custom booth builders specialize in modular designs which can be adapted to the space you are allocated, ensuring that your booth always looks its best.

- Multiple Functionality: Investing in a custom made booth enables you to create a single display that can serve many purposes at different trade shows, conferences or promotional events. The right custom booth design can easily be modified for different types of events, reducing costs for the business in the long run.

- Flexibility: Custom booths can easily be changed with updated branding, product displays, or even new technology to meet trends, ensuring your exhibit is always in alignment with your requirements. Custom booths enable you to offer new products, promotions, or even change your brand and still remain within set business needs.

Your investment in custom trade show design is guaranteed to retain its value over time due to the recurring event and needs based booth changes that will be required.

The Impact of Custom Booths on Engagement

Trade shows do not only revolve around your products; they can be used to directly target your audience. Custom trade show exhibits are specially customized for attendees to use in order to create more meaningful interactions with clients which results in many qualified leads and boosted ROI.

- Interactivity: Custom booth designers can also add interactivity to your design such as touch screens, product demos, and even virtual touch. These features compel attendees to interact with your booth and will ultimately remember your company.

- Customized Presentations: Custom booths enable you to go beyond generic presentations or product demos and tailor a booth to the particular interests and needs of the attendees. Live demonstrations or customized video content can be utilized so that your booth can address the target audience.

- F personally Branded Experience:For every custom booth, there are tremendous opportunities to create fully branded booths and immerse visitors into a brand experience. The impact of custom branded giveaways, custom signage and unique booth aesthetics is that these custom booths put attendees into the world of the brand.

The custom trade show booth design increases your chance of engaging every attendee at the show and making them capture and increase the chance of accumulating valuable leads.

Acquiring Custom Booth Rentals In Chicago

ROI matters when it comes to booth design, as it directly impacts oversized business gains. The custom designed booth will draw attention with a custom booth and guaranteed ROI and by attracting easily identifiable leads and revenue maximizing opportunities through.

With trade shows Chicago has booth design priorities and with custom booths, heavily allocated investment to refining branding can easily maximize ROI.

- Lead Generation with Higher Targeting Focus: Custom booths are created to appeal to specific demographics that make use of your services, which helps enhance your traffic. If you add a few right elements, like lead capture systems, interactive displays, and product touchpoints that encourage participation, you can convert attendees into willing suppliers of contact details, turning them into ideal leads for your follow-ups.

- Value Appreciation Over Time: Custom booths always require higher-out lay unlike other standard booths, they do offer long-term economical value because of their flexibility and sustainability. Unlike standard, off-the-shelf booths that may need to be replaced or updated frequently, a custom booth can be reused across multiple events, making it a more cost-effective option in the long run.

- Positivity in Brand Standing: You can enhance your reputation within the industry while being perceived in a positive manner by using custom booths that showcase your brand values or identity. A professionally done custom designed booth showcases your brand and shows off the seriousness and dedication of your company to quality which in turn enhances reputation and credibility.

Using custom booths ensures improved trade show experiences and aids in measurable leaps in business.

Conclusion

Custom trade show exhibits in Chicago can substantially improve your brand’s presence as well as ROI at a trade show, making it one of the smart moves in booth rentals. The custom booth builders have the required industry knowledge, creativity, and precision to design a custom trade show booth Chicago that will capture visitors’ attention, foster engagement, and still align with your brand’s identity.

Custom booths have no limitations when it comes to paying off making tailored designs that grab attention and increasing audience interaction. Custom booths not only provide unparalleled flexibility and scalability, but they also ensure that the investment continues to pay off in future events. Achieving the goal your brand aims for at the next trade show can be best accomplished by hiring skilled custom booth builders. The expertise of customization is what guarantees that your brand stands out amid the trade show booth rental Chicago as well as other events in different cities.

-

NEWS1 month ago

NEWS1 month agoWhat is www.avstarnews.com and What Does It Offer?

-

TECHNOLOGY2 months ago

TECHNOLOGY2 months agoGomyfinance Invest: Simplify Your Path to Financial Growth

-

TECHNOLOGY2 months ago

TECHNOLOGY2 months agoAtfboru: A Creative Platform for Designers, Artists, and Entrepreneurs

-

BUSINESS4 weeks ago

BUSINESS4 weeks ago.Ydesi: Exploring Its Significance and Applications

-

CRYPTO1 month ago

CRYPTO1 month agoCrypto30x.com Gemini: Revolutionize Your Crypto Trading Experience

-

EDUCATION5 months ago

EDUCATION5 months agothe christian between the gospel and society

-

ENTERTAINMENT6 months ago

ENTERTAINMENT6 months agoWWE SmackDown Episode 1491: Unforgettable Moments That Left Fans Roaring

-

HEALTH6 months ago

HEALTH6 months agoEmmyhii777: Unlocking the Power of Positive Social Connections