BUSINESS

The Rise of Bitcoin: How It Became the Digital Gold

Bitcoin has taken the world by storm, transforming from a niche digital currency into a revolutionary force in finance. Launched in 2009 by an enigmatic figure known as Satoshi Nakamoto, it began as an experiment in decentralized money. Fast forward to today, and Bitcoin is often referred to as “digital gold.” But what does that mean? As more people recognize its value and potential for wealth preservation, Bitcoin continues to capture headlines across financial news outlets.

With each passing year, this cryptocurrency solidifies its position as a leading asset class. Investors are flocking toward it not just for trading but also for long-term holding strategies. Its rise isn’t merely due to speculation; there’s substance behind the numbers. Dive deeper into the story of Bitcoin and discover how it became synonymous with innovation and opportunity in our evolving financial landscape.

The concept of digital gold and why Bitcoin fits the category

The term “digital gold” has emerged as a fitting description for Bitcoin. Just like gold, Bitcoin offers scarcity and durability. With a capped supply of 21 million coins, it shares that vital characteristic that makes precious metals so coveted.

Bitcoin’s decentralized nature further enhances its appeal. It operates outside traditional banking systems, making it accessible to anyone with an internet connection. This democratization aligns perfectly with the evolving financial landscape.

Moreover, Bitcoin acts as a hedge against inflation. As governments print more money, the value of fiat currency may diminish over time. In contrast, Bitcoin’s limited supply positions it as a refuge for those seeking stability in uncertain economic climates.

Its liquidity is another key aspect that strengthens its claim to digital gold status. Investors can easily buy or sell Bitcoin on various exchanges around the clock, providing flexibility and convenience rarely found with physical assets.

Factors that contributed to the rise of Bitcoin

Several factors fueled the rise of Bitcoin, starting with its groundbreaking technology. The underlying blockchain offers transparency and security, attracting users wary of traditional banking systems.

Another significant factor was the growing distrust in fiat currencies. Economic instability and inflation rates led people to seek alternative assets that could retain value over time.

A major boost came from media coverage and celebrity endorsements. As prominent figures began discussing Bitcoin, it gained mainstream attention, drawing in a broader audience.

The establishment of cryptocurrency exchanges also played a crucial role. These platforms made buying and selling Bitcoin more accessible to everyday investors.

The advent of decentralized finance (DeFi) created new use cases for Bitcoin beyond mere speculation. This evolution turned it into an integral part of the digital economy, paving the way for further adoption.

The impact of Bitcoin on the financial world

Bitcoin has significantly disrupted traditional finance. It introduced a new way for individuals to store and transfer value without intermediaries. This peer-to-peer system reduces transaction costs and increases efficiency.

Financial institutions are adapting rapidly. Many banks now offer Bitcoin-related services, acknowledging its growing importance. Investment firms have also started incorporating Bitcoin into their portfolios, treating it as a legitimate asset class.

The rise of Bitcoin has sparked innovation in payment systems and blockchain technology. Companies are exploring smart contracts and decentralized finance (DeFi) applications, broadening the scope of financial transactions.

Regulatory bodies face challenges in keeping pace with this evolving landscape. As they seek to implement guidelines, the balance between fostering innovation and ensuring consumer protection remains delicate.

With institutional interest surging, Bitcoin’s influence on global markets cannot be ignored. Its volatility may pose risks, but its potential rewards captivate investors worldwide.

Challenges and criticisms faced by Bitcoin

Bitcoin faces numerous challenges that have sparked debate among enthusiasts and skeptics alike. One significant concern revolves around its volatility, which can lead to dramatic price swings in short periods. This unpredictability makes it a risky investment for many.

Moreover, Bitcoin’s association with illicit activities has raised eyebrows. The pseudonymous nature of transactions can facilitate money laundering and other illegal operations, tarnishing its reputation.

Scalability is another pressing issue. As more users flock to the network, transaction speeds can suffer during peak times, resulting in longer wait times and higher fees.

Environmental impact also garners criticism. The energy consumption required for Bitcoin mining is substantial, prompting concerns about sustainability.

Regulatory scrutiny continues to grow as governments grapple with how to handle this emerging asset class while protecting consumers without stifling innovation. These factors contribute to ongoing debates about Bitcoin’s long-term viability within the financial ecosystem.

Future predictions for Bitcoin

Looking ahead, Bitcoin’s trajectory remains a hot topic among investors and analysts alike. Many believe it will continue to mature as an asset class. As institutional adoption increases, the demand for Bitcoin could rise significantly.

With regulatory frameworks slowly evolving worldwide, clearer guidelines may encourage more mainstream acceptance. This shift could lead to increased usage in everyday transactions and further integration into financial systems.

Technological advancements also play a crucial role. Innovations like the Lightning Network aim to enhance transaction speed and reduce costs, making Bitcoin more practical for daily use.

However, market volatility is likely to persist. Price fluctuations can create uncertainty but might also present lucrative opportunities for traders who understand the dynamics at play.

Predictions vary widely—from bullish forecasts of soaring prices to cautious outlooks highlighting potential pitfalls—making it essential for enthusiasts and newcomers alike to stay informed about ongoing developments in this ever-changing landscape.

Conclusion: Is Bitcoin here to stay as the new digital gold?

As we look at the evolution of Bitcoin, it’s clear that its journey has been nothing short of remarkable. From its humble beginnings in 2009 to becoming a household name, Bitcoin has captured the attention of investors and everyday users alike. Its classification as “digital gold” resonates with many due to its limited supply and potential for long-term value retention.

The factors fueling this rise—ranging from technological advancements to increased institutional adoption—paint an optimistic picture for Bitcoin’s future. It has revolutionized how we think about money, challenging traditional financial systems while offering new opportunities for wealth creation.

Yet, challenges remain. Regulatory scrutiny and environmental concerns are significant hurdles that could shape Bitcoin’s trajectory moving forward. Criticisms regarding volatility and security also linger in discussions surrounding cryptocurrency.

Predictions vary widely among experts: some believe Bitcoin will solidify itself as a stable form of digital currency, while others warn of potential pitfalls ahead. Despite these uncertainties, one thing is clear: interest in Bitcoin shows no signs of waning.

Whether you view it as a store of value akin to gold or simply another speculative asset depends on your perspective. But what remains undeniable is the impact it has had on our financial landscape—and whether it’s here to stay may hinge on both market adaptability and innovation within the cryptocurrency space.

BUSINESS

Why Your Next Paper Bag Should Be Custom and Plastic-Free

With the ever-increasing pace of the global move to sustainability, food industries, cafes, bakeries, and stores are reassessing what effect their packaging will have on the environment and the minds of the clients, respectfully. Nowhere in this ecologically conscious environment has an aspect more emerged as a nice to have that is mandated to be a must have than the use of custom paper bags.

Costing a combination of aesthetics, eco-friendliness, and brand narration, custom paper bags are not only environmentally friendly but also market-savvy, a win-win game between your business and the environment. When your company relies on takeaway package materials, it is time to consider why your future paper bag would be custom and made of plastic.

Wise Material Selection to Wise Businesses

The first step towards sustainability is the materials that you use. Conventional plastic bags are good in terms of being cheap, yet they are notorious in terms of taking a long time to decay, and they are bad for the environment. In comparison, the biodegradable and compostable paper bags, in particular, those manufactured using the recycled material or by a way of the FSC eco-friendly certification method, biodegrade and do not create an immense amount of environmental impact.

Companies, which integrate sustainable takeaway packaging supplies, show their dedication not only to the quality of their products, but to the values that are highly valued by the modern consumers. Change to paper bags without plastic and save landfill waste, minimize regulatory waste risks in using plastic and comply with your operations with a clean future.

Moreover, the printing process is also eco-friendly as the particular inks are water-based or soy-based. The ink does not cause pollution as they are non-toxic and degrade in nature causing minimum pollution and ensuring the high quality of the prints. Selecting materials carefully is not only a step towards good business, but it is an apparent pronouncement of what shoppers do not forget.

Customization Development of Brand Identity

Great packaging is frequently the physical first impression on your brand. A custom paper bag with a good design informs your brand story in a manner that is objectively concrete, pictorial, and effective. You may incorporate logos, color schemes, seasonal motifs, and green messages all that would enhance your brand image.

It can be a simplistic style of design with an expensive patisserie or it can be a bright and strong-colored one with a vivid cafe; custom bags can make an individual see and know your brand. Printing on paper recreates precise graphics and intricate designs that may transform an ordinary bag into a billboard of the brand in question as compared with printing on plastic which produces only blurred graphics and designs.

Moreover, bespoke packaging creates the space to have seasonal sales, partnerships and limited edition of artwork which will allow sharing it on social media. When goods or products with good-looking packaging are shared online by customers, it amounts to natural promotion to improve exposure and reputation.

Waste to Trust: Acquiring the Customer Loyalty

Reflecting on the environment is not the only reason you should be attached to sustainable packaging; instead, it is a sure measure to win the trust of your patrons. In the market where buyers investigate a company’s environmental impact before making the purchase, plastic-free packaging provides the direct confirmation. Your clients will be more apt to patronize you again when they are made to feel that the value is shared between them and the business as opposed to the business being focused on the bottom line.

To add to this trust, you can share your packaging story with your customers, via your web site, your store signage or even on printed messages on your bags. Being transparent creates a relationship, and a simple addition such as making note of the fact that the bag can be used to fit compost waste or with components that have been recycled can add a lot to the impression of your brand by customers.

In a single sentence: The whisky bakery boxes wholesale and other takeaway packaging materials that are customized and plastic-free by retailers are resounding in an environment that promotes sustainability- responsibility.

Your loyal customers also become to-be brand advocates and recommend your products or leave positive comments on the Internet. When their values draw on your packaging, they are better motivated to come out to the support of your product, which acts as free marketing with high possibility of trust.

Combining Marketing and Practicality for Maximum Impact

Marketing of your brand outside stores is one of the benefits of buying custom paper bags that are commonly ignored. Each bag turns into a mobile advertisement that is noticed on the streets, subways as well as in office break rooms. This brand recognition comes without incurring extra advertising costs as this exposure is passive. Whenever your bag design arouses people’s curiosity, they will feel more willing to research about your business or even enter your store the next time they see it.

Concurrently, there is a commonly spread belief that becoming ecologically friendly will be costly, which is no longer the case. Due to the improvement of takeaway packaging, there are numerous custom-printed paper bags that highly match the competitors, particularly on large purchases. The suppliers have come up with the flexible designs reinforced lines like handles, waterproof and even grease-proof linings all of which are both stylish and functional.

More to the point, currently, when cities prohibit the usage of plastic bags or apply some taxes on them, the decision of selecting the paper is the one which protects your brand against the legal or image risks. Brands that smartly package their wares are no longer tolerated but enjoyed by the customers and being able to provide something that is well-designed and long-lasting in its sustainable package can have an effect that is ever-lasting.

Pass Your Brand Onward, and Your Values

Using paper bags, as custom bags instead of using plastic, is not merely a box checking move by your company under sustainability, it is a loud declaration of what you value most as a company. These bags are your morals, your imagination and commitment to good quality and consumer satisfaction.

Paper bags are a notable change that can be impacted with ease in the takeaway supply packaging industry as more businesses pursue materials that meet the current environmental consumer demands. Combined with other environmentally conscious decisions, such as biodegradable cutlery or bakery boxes wholesale made out of recycled board, your packaging will be more of a visual representation of your brand goal.

It is not only a matter of short-term impressions anymore, packaging is a part of a brand experience. The customers today are detail conscious. They circulate them. They verify them. And they do not forget them. A paper bag is customizable and the color, print and design of the bag can make your product feel luxe, nice and environmentally friendly in a single move.

Your packaging is not a last-minute idea. Create benefits out of it. Make it personal. Make it plastic free. And in the process ensure that you make your brand memorable.

BUSINESS

.Ydesi: Exploring Its Significance and Applications

The term .Ydesi is steadily gaining attention across industries, yet many remain unclear about its full significance and real-world applications. Whether you’re new to .Ydesi or looking for deeper insights, this blog aims to unravel its importance and showcase its versatility across diverse sectors.

You’ll learn about the origins of .Ydesi, why it matters, and how it’s being applied in practical scenarios. By the end of this article, you’ll have a better understanding of how .Ydesi could revolutionize various workflows.

What is .Ydesi?

.Ydesi isn’t just a buzzword—it’s a cutting-edge system/tool (define .Ydesi more explicitly depending on what it refers to, such as software, a framework, methodology, etc.).

Officially introduced in [relevant year], .Ydesi was designed with the goal of amplifying [specific purpose]. Its adaptable nature allows it to integrate seamlessly into various business, creative, or technological landscapes.

Core Features of .Ydesi:

- Scalability: [Example feature description]

- User-Friendly Design: [Feature description]

- Flexibility Across Platforms: [Feature description]

With these features, .Ydesi is becoming indispensable for those aiming to stay competitive and efficient in their respective industries.

Why .Ydesi Matters

To fully grasp the importance of .Ydesi, you need to understand the issues it addresses. Today’s digital and organizational landscapes are swamped with [describe challenges]. .Ydesi tackles these obstacles with its innovative features that streamline processes and yield tangible results.

Key Benefits of Adopting .Ydesi

- Improved Efficiency: Businesses report up to a [specific percentage] increase in workflow efficiency after implementing .Ydesi.

- Seamless Collaboration: Features [describe like team management tools, shared resource hubs, etc.] facilitate smarter teamwork.

- Cost Savings: By reducing redundancies in [specific processes], .Ydesi helps teams cut operational costs.

- Customizability: Whether you’re an enterprise or an individual, you can tailor .Ydesi to suit your exact needs.

These advantages illustrate how .Ydesi goes beyond being a standard tool—it becomes a central asset in achieving organizational goals.

Practical Applications of .Ydesi

1. Business Operations

Streamlining processes is where .Ydesi shines the most. Companies leverage it to optimize supply chain logistics, reduce administrative bottlenecks, or even bolster decision-making through AI-backed solutions.

Example Use Case

A mid-sized firm using .Ydesi reported cutting approval times for internal processes by 35% within the first quarter of adoption.

2. Creative Industries

.Ydesi supports creative teams by centralizing resources like brand guidelines, design templates, and project timelines.

Example Use Case

Creative agencies cited reduced delivery times for client projects when incorporating .Ydesi-powered frameworks.

3. Education

Whether managing curricula or conducting research, .Ydesi plays a critical role in modern educational institutions by facilitating centralized learning environments.

Example Use Case

[Insert a reference to how a specific university improved scheduling or engagement tracking using .Ydesi].

4. Healthcare

The complexity of managing healthcare operations is often overwhelming, but .Ydesi simplifies patient management systems, billing workflows, and even telemedicine platforms.

Example Use Case

Hospitals leveraging .Ydesi’s customizable tools experienced an 18% increase in operational satisfaction among staff.

5. Freelance Work

Freelancers often manage multiple clients and tasks simultaneously. The organizational tools .Ydesi offers help independent contractors stay on top of deadlines and communications.

Example Use Case

Freelancers using .Ydesi noted improved time management and client satisfaction scores.

Tips for Implementing .Ydesi Effectively

To enjoy the full benefits of .Ydesi, thoughtful implementation is essential. Here’s how you can ensure seamless integration into your workflow.

- Understand Your Needs: Identify why your team or organization needs .Ydesi. From productivity tools to workflow automation, aligning features with your goals ensures success.

- Train Your Team: Conduct training sessions to familiarize your team members with .Ydesi. The more confident they feel using it, the quicker you’ll see results.

- Start Small: Begin with one department or project before scaling up. This allows for troubleshooting and feedback to fine-tune usage patterns.

- Regularly Review Performance: Periodically evaluate how well .Ydesi is meeting your objectives and adjust settings or workflows accordingly.

How to Get Started with .Ydesi

If you’re intrigued by what .Ydesi has to offer, you’re not alone. Many individuals and organizations are already seeing its capabilities take their efforts to the next level.

To begin, visit [insert URL or platform details]. Depending on your needs, you can sign up for a trial or reach out for a consultation that aligns .Ydesi’s potential with your unique requirements.

Bringing It All Together

The significance of .Ydesi extends far beyond its basic functionalities. From empowering businesses to fostering creativity and collaboration, its applications are as diverse as its users. By integrating .Ydesi into your processes, you’re investing in efficiency, innovation, and growth.

Now the only question is—are you ready to explore what .Ydesi can do for you?

BUSINESS

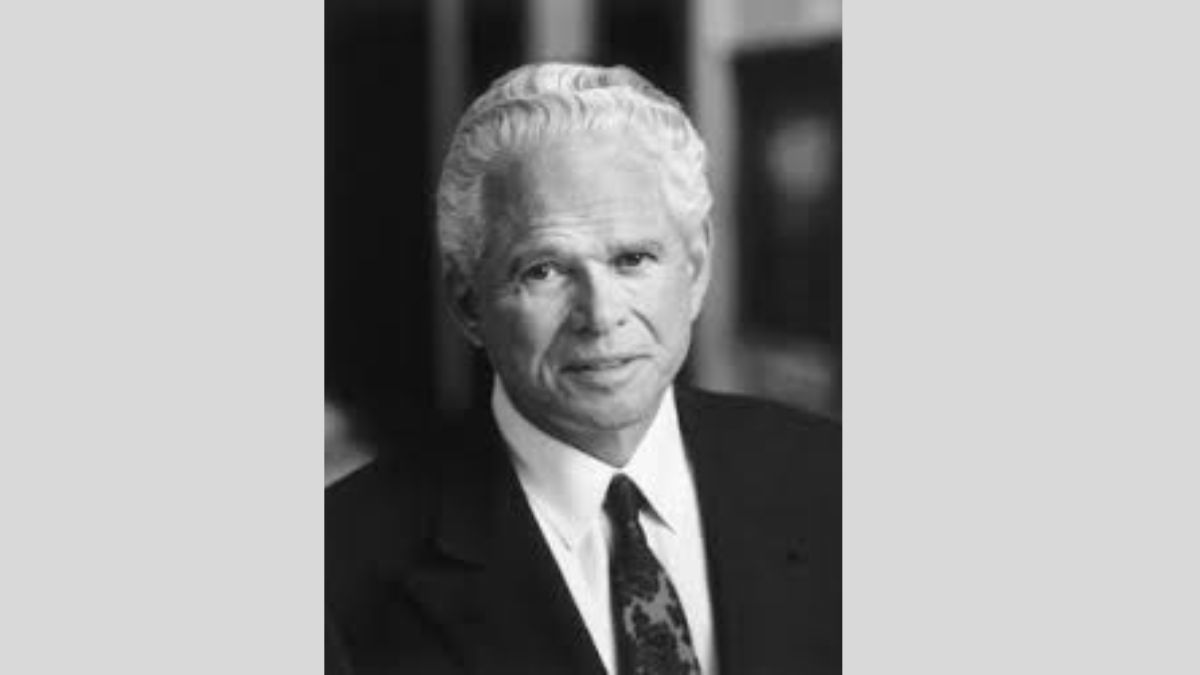

John Teets, Dial and Greyhound Chief, Dies at 77

The business world has lost one of its most trailblazing minds. John Teets, the former CEO of Dial Corp and Greyhound, passed away at the age of 77. A visionary leader with an incredible knack for revitalizing businesses, Teets left a lasting legacy that continues to shape the industries he touched.

This article pays tribute to his extraordinary life, detailing his career highlights, leadership philosophies, and the profound impact he made on American businesses.

Early Life and Career Beginnings

John Teets was born in 1945 in South Dakota and grew up in a working-class household. His early experiences instilled in him a tireless work ethic and determination—qualities that would later define his career. Teets began his professional career in journalism, earning a degree from the University of Denver and working for the Associated Press. But he soon transitioned into the corporate world, where his talents for leadership and strategic thinking became abundantly clear.

Revolutionizing Dial Corp

Teets joined Dial Corp in the 1970s and quickly rose through the ranks. By 1981, he had been appointed CEO. At the time, Dial Corp was a struggling conglomerate juggling operations in various sectors, including soap, food products, and services.

Under Teets’ leadership, Dial underwent a systematic transformation. Teets refocused the company’s portfolio, choosing to divest non-core businesses and streamline operations. His sharp business acumen allowed Dial to hone its existing strengths, particularly in consumer goods such as soap and personal care products.

Teets’ efforts propelled Dial Corp into profitability and set it on a course for long-term success. His tenure remains a textbook example of how targeted strategic decisions can rescue a struggling company.

Reinventing Greyhound

One of John Teets’ most notable achievements came when Dial acquired Greyhound in the early 1980s. Greyhound, the iconic bus company, was facing declining ridership and financial struggles. Many believed the company was beyond saving, but Teets saw opportunity where others did not.

Teets implemented sweeping changes aimed at modernizing Greyhound’s operations. He overhauled the fleet, introduced better service models, and executed effective marketing campaigns to reinvent the brand. Most importantly, Teets identified the need for customer-centric innovation—something that set Greyhound apart in the competitive transportation industry.

Remarkably, under Teets’ leadership, Greyhound was able to regain public trust and rebuild its reputation as an affordable, reliable means of long-distance transportation.

Strategic Leadership and Legacy

John Teets was renowned for his sharp eye for strategy and his ability to execute decisive action at the right time. His leadership philosophy combined pragmatism with innovation, and he was not afraid to make bold moves—even when the odds seemed stacked against him.

Above all, Teets placed immense value on teamwork. He believed that the best organizational changes came from collaboration, enabling employees at all levels to feel a sense of ownership in the company’s success.

Many who worked alongside Teets praised his charismatic personality, deep strategic understanding, and unrelenting ambition. Beyond just being a corporate leader, Teets inspired individuals to aim higher and do better.

His Impact and Future Lessons

Though John Teets achieved great success during his lifetime, his influence extends far beyond the accomplishments listed under his name. His work revitalized entire industries and demonstrated how businesses could thrive even amidst economic turbulence.

For leaders and entrepreneurs, Teets’ career serves as a masterclass in adaptability and vision. His ability to view challenges as opportunities, coupled with his relentless focus on customer satisfaction, stands as a guiding light for future generations.

Honoring a Life Well-Lived

John Teets’ passing marks the end of an incredible chapter in American business history, but his contributions are far from forgotten. Whether it was saving Greyhound from irrelevance or ensuring Dial Corp’s survival, Teets proved time and again that a visionary leader can achieve the impossible.

He is remembered not only as a business luminary but also as a mentor, friend, and inspiration to those who had the privilege of knowing him.

John Teets’ remarkable journey in the world of business leaves an indelible mark on history. His visionary leadership, unwavering commitment to customer satisfaction, and ability to transform industries serve as a timeless source of inspiration for future generations. As we honor his legacy, we celebrate not only his business accomplishments but also the profound impact he had on the lives of those fortunate enough to know him. May his legacy continue to inspire bold ideas and innovative leadership, guiding us toward a brighter future.

May his legacy continue to foster bold ideas and innovative leadership for years to come.

-

NEWS1 month ago

NEWS1 month agoWhat is www.avstarnews.com and What Does It Offer?

-

TECHNOLOGY2 months ago

TECHNOLOGY2 months agoGomyfinance Invest: Simplify Your Path to Financial Growth

-

TECHNOLOGY2 months ago

TECHNOLOGY2 months agoAtfboru: A Creative Platform for Designers, Artists, and Entrepreneurs

-

BUSINESS1 month ago

BUSINESS1 month ago.Ydesi: Exploring Its Significance and Applications

-

CRYPTO1 month ago

CRYPTO1 month agoCrypto30x.com Gemini: Revolutionize Your Crypto Trading Experience

-

EDUCATION5 months ago

EDUCATION5 months agothe christian between the gospel and society

-

ENTERTAINMENT7 months ago

ENTERTAINMENT7 months agoWWE SmackDown Episode 1491: Unforgettable Moments That Left Fans Roaring

-

HEALTH6 months ago

HEALTH6 months agoEmmyhii777: Unlocking the Power of Positive Social Connections